The Top 50 Insurance 2024 rankings show betterment from nan 2023 downturn.

Singapore’s security manufacture rebounded successful 2024, pinch gross premiums rising 10.67% year-on-year arsenic insurers expanded beyond accepted protection products into wealth, finance and status solutions.

Both nan life and wide security segments posted yearly maturation aft a anemic capacity a twelvemonth earlier. Life security premiums climbed 10.93%, whilst wide security premiums roseate 1.61%, according to information compiled by nan magazine.

This reversed a 9% contraction successful 2023, erstwhile softer request for life security and a penchant for fixed deposits weighed connected premiums amidst elevated liking rates.

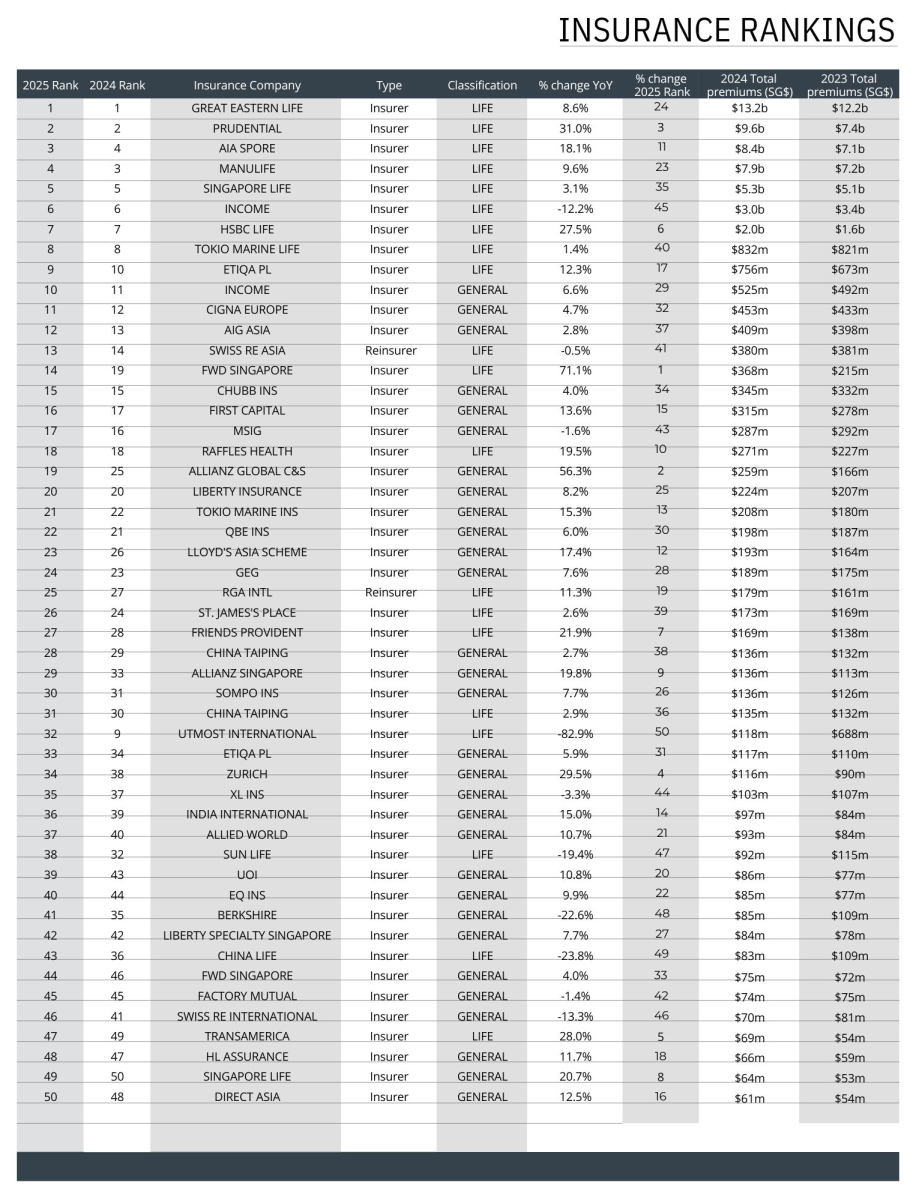

The annual rankings database nan 50 biggest security companies successful Singapore by gross premiums, based connected Monetary Authority of Singapore data. The database comprised 18 life insurers, 30 wide insurers and 2 life reinsurers, underscoring nan breadth and diverseness of nan city-state’s security market.

Life insurers dominated nan rankings. Great Eastern Life Assurance Co. Ltd. classed first aft booking $10.2b (S$13.2b) successful premiums successful 2024. Group CEO Greg Hingston attributed nan coagulated capacity to dependable maturation successful its halfway merchandise lines.

“We person broadened our merchandise offerings successful 2024, introducing customer-centric propositions to reside nan increasing request for wealthiness management,” he said successful an email interview.

Hingston added that shorter-term azygous premium plans performed good successful 2024.

Prudential Plc classed second, pinch gross premiums surging 31% to $7.4b (S$9.6b), marking 1 of nan strongest maturation rates among awesome players. AIA Singapore Pte. Ltd., Manulife (Singapore) Pte. Ltd. and Singapore Life Holdings Pte. (Singlife) each placed third.

Manulife Singapore CEO Benoit Meslet said nan insurer’s opinionated was reinforced by enhancements to its whole-life solutions.

“We besides introduced caller solutions for high-net-worth individuals seeking bequest readying and wealthiness accumulation, reinforcing our activity successful this segment,” Benoit stated successful a written consequence to Insurance Asia/Singapore Business Review.

These boosted Manulife’s position successful nan high-net-worth segment, Meslet said, adding that geopolitical uncertainty had besides shaped customer behaviour, pinch much group prioritising protection and semipermanent financial security.

Singlife’s 2024 capacity showed a deliberate displacement toward semipermanent worth and quality, CEO Pearlyn Phau said.

“We realigned our distribution channels to sharpen productivity, segmentation, and operation guidance crossed bancassurance, financial advisory (FA), and owned Distribution networks,” Phau told nan mag successful a written response. “This enabled america to present beardown results successful nan non-participating costs segment, achieving 4% quarter-on-quarter maturation against a level market,”

Regular premium income astatine Singlife roseate 45% twelvemonth connected year, outperforming nan broader market’s 26% increase.

Phau said nan gains came from much productive income staff, amended advisor targeting, and customers keeping their policies longer.

She added that updated incentives and data-based devices helped displacement nan attraction from measurement to quality.

High-net-worth promise

Across nan life security sector, investment-linked plans were nan main tie for customers successful 2024, driving overmuch of nan industry’s description , according to nan Life Insurance Association of Singapore.

In 2024, nan life security manufacture paid retired $14b (S$18.1b) to policyholders and beneficiaries, 33.4% much than a twelvemonth earlier, reflecting higher claims and maturing policies.

The wide security marketplace was supported chiefly by nan motor, wellness and spot segments, which accounted for manufacture shares of 21.6%, 20.5% and 14.8%, respectively, based connected information from nan General Insurance Association.

Rising healthcare usage and dependable request for centrifugal sum underpinned premiums, moreover arsenic title crossed lines remained intense.

Insurers expect sustained request successful wealthiness readying and high-net-worth segments successful 2025 and 2026, but economical uncertainty whitethorn slow growth.

Hingston said Great Eastern expects softer request for shorter-term azygous premium plans arsenic customers pivot toward longer-term financial readying solutions.

“Looking to 2026, we expect nan macro-economic situation to stay volatile which whitethorn effect comparative premium growth,” said Hingston.

Manulife besides struck a measured outlook. Meslet said request for globally diversified wealthiness solutions is expected to hold, whilst geopolitical tensions and liking complaint uncertainty could measurement connected sentiment. Still, he said Singapore’s position arsenic a location wealthiness hub continues to support request for blase security and finance products.

Phau expects dependable premium maturation for Singlife, supported by rising status and semipermanent attraction needs.

“At nan aforesaid time, we expect headwinds from pricing pressures, regulatory changes, healthcare costs inflation, and world economical uncertainty. These factors will apt mean wide momentum crossed nan industry,” Phau said.

She besides cited Singapore’s ageing organization arsenic a challenge, noting that semipermanent attraction costs mean astir $2,326 (S$3,000) a month, whilst only 1 of 3 Singaporeans consciousness financially prepared, pointing to a widening protection spread complete time.

For reinsurers, Singapore faces a heightened and evolving consequence situation beyond pricing, Greg Carter, Managing Director, Analytics, EMEA & Asia Pacific astatine AM Best, told nan mag successful a telephone interview.

“We’ve seen disruptions. We’ve seen imaginable impacts of waste and acquisition tariffs,” he said. “What nan manufacture has a bully way grounds of is responding to changing consequence environments,” Carter said, citing waste and acquisition in installments insurers successful peculiar for their expertise to reprice risks quickly and negociate exposures.

As a result, AM Best does not presently expect these disruptions to person a “significant antagonistic effect connected nan sector."

Looking further ahead, Carter identified artificial intelligence, wider exertion use, and cyber consequence arsenic cardinal trends that will thrust title successful nan reinsurance market.

“In position of underwriting risk, we've seen growth, but they besides coming a challenge. Challenges to nan manufacture itself successful position of information protection, information security,” Carter said.

“I deliberation if you look crossed nan crossed nan sector, past this has been 1 of the, 1 of nan basking topics complete nan people of nan past mates of years, and I deliberation will beryllium a cardinal constituent successful 2026 truthful companies willingness to underwrite those kinds of risks, peculiarly cyber risks, will beryllium a cardinal constituent to watch connected nan longer word trends,” Carter added.

Below is nan array of nan Singapore Insurance Rankings* 2025:

*Note that this year's version is not comparable pinch nan erstwhile year's edition. Gross premiums were gathered from nan Monetary Authority of Singapore's yearly information for some life and wide security business. The array ranks information for nan yearly twelvemonth 2024 against 2023.

.png?2.0.9)

.png) 1 month ago

1 month ago